The for-profit insurance industry has two goals: 1) to take your money; and 2) to keep your money.

They’ll always pay you as quickly as they can after an auto accident, because they can get you to be excited over a lump sum. It may seem like a large amount at first, and you may be happy to sign a legally binding document stating you don’t need more money.

But then what?

Over time, you get previously unseen car damages, unexpected medical bills, lost wages from being out of work, physical therapy costs…these things add up, and often add up to much, much more than the insurance company gave you. And when you signed their papers, you gave away your right to get more money to cover those new costs.

…Or did you?

What the Insurance Companies Don’t Want you to Know

Insurance companies try very hard to make the public believe that they are on our side. They put forth a friendly and accommodating face to reassure us they will look out for us. They create humorous TV commercials to build up a positive perception of their brand.

But make no mistake, it’s not the insurance company’s job to represent your needs and best interests. Their job is to save the company money, plain and simple. And they will lure you in with the promise of a nice check and quick resolutions to your claims.

But what they don’t tell you is how they really make money, or what they will do in order to protect their own bottom line.

Insurance companies view personal injury claims in two ways: how they can minimize their costs and how they can manage risk.

They will do everything in their power to resolve a claim before it reaches a courtroom. In fact, they want to resolve the claim before it even gets into a lawyer’s hands. So they quickly offer a lowball payout to the victim and cross their fingers it gets accepted.

But when a claim is brought against their insured, they vastly prefer a settlement agreement to be reached, in which the car accident victim receives a sum of money and the insurer and defendant are released from any further liability for the injuries.

The last thing an insurance company wants to do is let a personal injury case go to trial. Juries are unpredictable and may award the plaintiff hundreds of thousands if not millions of dollars – well above what they had budgeted.

So, when you sustain an injury in an auto accident, it’s in the best interests of the insurance company to offer you a modest amount in compensation, hope you agree to sign it, and move on. This way, they keep more money in their pocket and keep themselves exempt from paying you more money in the future.

Here are some additional things they don’t want you to know:

- They profit off investments, not premiums: Insurance companies make the majority of their money off investing the premiums you send in. They profit hugely off your money. This is why insurance companies are unwilling to part with large sums of money when faced with paying out a claim. It doesn’t make them look good when their bottom line takes a hit.

- They are more likely to settle with clients who hire lawyers: Insurance adjusters will do what they can to persuade clients from retaining a legal team. When that fails, they go to the next precautionary measure and attempt to settle the matter for too little but fast, cut their losses and avoid going to trial. They never want to hear you say “I lawyered up.”

- They keep track of everything you say: Everything you say during negotiations is being recorded. Adjusters are trained in the art of negotiating, to be sure, but they also record your statements and keep track of emails so they can find holes in your story or inconsistencies in your claim. They do this to reduce liability or even challenge the validity of your claim outright. This is why you should never speak to an insurance company before speaking to a lawyer first. We will do the talking for you.

- They will try to threaten you with legalities: Insurance companies routinely try to scare people by telling them if they don’t accept their offer, they will experience adverse legal implications. They may even say you are throwing your right away to seek further damages in the future. Look at this for what it is: they’re in a bad position and are scared you will seek legal counsel. Always ask your personal injury lawyer about the law – WE KNOW THE LAW, and we know their tactics. Just keep in mind you must file your claim within the statute of limitations in California (in most cases, two years). So don’t wait a second to contact Kuzyk Personal Injury & Car Accidents Lawyers.

How Does an Insurance Adjuster Determine a Settlement Offer?

Did you ever wonder how an insurance company values a personal injury in a car accident, or how they come up with what they believe is a reasonable settlement amount?

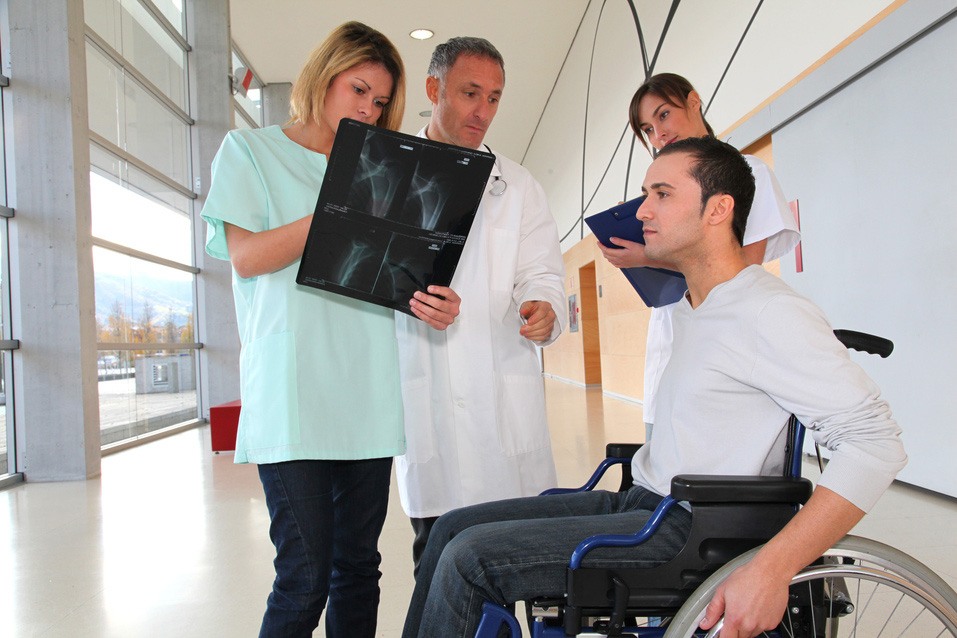

After an auto accident, you’ll hear from an insurance adjuster fairly quickly. An insurance adjuster is a person who works for the insurance company, and it’s their job to determine the value of claims made against their company. Because they work for the insurance company and not for clients, you can assume correctly that their motivation lies in settling for the least amount of money they can. Their job security depends on it.

And that means you can expect the amount from them to be on the low side – the very low side.

As part of their process, the insurance adjuster will put great effort into researching your case — not necessarily to find out the facts to bolster your case or give you more money for your injuries. They may search for excuses not to pay you. They may try and discredit you as the victim.

Things can get pretty nasty. They’ll take statements from both parties involved in the accident, take a look at the police report, review medical records involved, and interview doctors and witnesses. In addition, they often look into a victim’s personal background to find anything in their personal history they can use as fodder for their own case. It’s not fair to the victim, and to the insurance company it’s just business.

Next, they will determine the following to come up with a settlement offer:

- Extent and severity of injuries

- Documented expenses such as medical bills and property damage as a result of the accident.

- Loss of wages (past, present, and future)

- Pain and suffering

- Permanent physical disability or disfigurement

- Emotional damages

Once the adjuster has all the facts in hand, he or she will consider the strength of your case. If they think you have a strong case and that you would likely make off with a large sum of money in a jury or judge trial, they will offer a larger payout. If they think you have a weak case, they will low-ball you.

We see this all the time. Our personal injury lawyers will know exactly which scenario is taking place and can advise you accordingly. Let us help you. We work to make the insurance company know you have a great case, and that they had better pay a fair settlement or risk getting crushed by a jury.

The documented expenses may be fairly easy to calculate, but how do they place a dollar amount on the pain and suffering and emotional damage? They typically go by either a per diem system or a pain multiplier system that follows a proven system of mathematics, statistics and risk management.

Under a per diem system, the adjuster puts a value on each day the victim suffered, multiplying it by the number of days of suffering.

Under the pain multiplier system, they will multiply the amount of money from medical bills and lost wages by a pre-determined number, usually falling between 1 1/2 and 3.

One final way they will come up with a settlement is by looking at the policy value of the insured. If there is a maximum amount that is stipulated, then the insurance company doesn’t have to pay out more than that specified max. That means that even if a jury verdict is massive, the insurance company does not have to pay more than what’s on that contract (this is referred to as a “policy limit”).

In a nutshell, insurance adjusters are trying to protect their bottom line while at the same time trying to appease you with a lowball sum that, in their minds, will cover the cost of your immediate medical bills. Problem is, particularly with TBIs and spinal cord injuries, the initial cost of the injury is tiny compared with months, years or a lifetime of medical, rehab and surgical bills.

What the insurance company offers and what you will accept represents a very fine line. Most people, going unrepresented by a personal injury lawyer, will accept the first offer they get. Smart people who call a lawyer right after the injury know they can hold out for much more. The insurance adjuster knows this too. That’s where the power of negotiation comes into play so you can get the maximum amount of compensation.

What Do You Give Up When You Sign on the Dotted Line with the Insurance Company?

Generally speaking, your personal injury claim ends at the point where you accept the insurance company’s offer. If you decide to retain the services of a lawyer instead, you reject that lowball insurance payout and roll the dice with a negotiated settlement and/or a jury verdict.

Let’s back up a bit: as in anything else, there is often room to negotiate.

If you get a low offer from the insurance agent initially, you can counter with your own offer. Your letter should outline the extent of your injuries and all your reasons as to why you deserve more. Good luck getting more. If you do this on your own without a lawyer, the insurance company will smell weakness a mile away and send you yet another lowball offer.

In many cases, going back and forth is a waste of your time. Either you accept the payment or not. But you may be wondering: what am I giving up if I sign on the dotted line?

As it turns out: quite a lot.

It isn’t uncommon to receive a low settlement offer from the insurance company. But don’t ever agree to an amount that is not in line with your injuries and other losses. By making such a low offer, remember that the adjuster is testing you to determine if you’re impatient enough to accept his or her initial offer.

Sadly, this is a technique that works all too well, way too many times. People get stuck in financial hardship for years afterward because of this technique. In fact, we had a client who settled for a measly $1,500 with an insurance company, but luckily, we were able to get that settlement agreement thrown out based on a technicality, and the insurance company ended up paying out $250,000. This just shows how much an insurance company will take advantage of poor victims of an accident, rather than pay a fair settlement. They are just greedy and heartless.

Instead of hassling with these offers and trying to decide if it’s good enough, call Kuzyk Personal Injury & Car Accidents Lawyers. Let our personal injury experts do the deciding. We know exactly what’s fair and what’s not. We can also tell you your legal rights if you decide to reject or accept their offer.

If you accept their terms, you must typically agree to forfeit all future payouts from them. But there are exceptions to every rule. We’ve gotten severely low offers tossed out in court, as we mentioned above, but it is very hard to do, and it is always better to seek good legal advice before signing anything. If your situation is similar, we may be able to do it for you. But you need to call Kuzyk Personal Injury & Car Accidents Lawyers today at 661-945-6969 and talk with us about your case.

Why You’re Better Off Rejecting the Insurance Payout and Pursuing a Lawsuit Instead

When you have been involved in a very serious accident sustaining major injuries, filing a personal injury lawsuit could be your only realistic option for obtaining adequate compensation. Sometimes, as we stated above, the insurance company can only give a victim so much, as set forth in the original policy. But your injuries may be so grave that you financially cannot settle for that amount.

Seeking compensation through a lawsuit can ensure you get enough money above and beyond that max, for:

- Medical bills incurred in treating the injuries

- Physical pain

- Emotional suffering and mental anguish

- Lost wages due to not being able to work during recovery

- Reduction in earning capacity due to your injuries

- Disability accommodations for your home and vehicle

- Lower quality of life

- Loss of companionship and support (in the event your loved one died a wrongful death)

Personal injury lawsuits should never be filed out of spite at the at-fault party or anger at the insurance company for offering a lower amount than you expected. The decision to sue is one that should be objectively and carefully thought out. Your personal injury attorney can help you make an informed decision about whether a lawsuit is the appropriate avenue for you.

A big part of a decision to carry out a lawsuit will depend on the extent of your injuries. Serious injuries include:

- Dismemberment

- Disfigurement or scarring

- Bone fractures

- Serious burns

- Loss or significant limitation of a bodily organ or limb

- Spinal cord injuries: herniated discs, broken backs, broken necks, etc.

- Any injury that keeps you from taking part in normal activities for an extended period of time (usually more than 90 days)

- Death of a loved one

In the end, it’s best to consult with a lawyer before you reject the insurance company’s payout. Our experienced team can weigh every factor of your case and advise you on the best course of action. In many cases, the insurance payout is indeed too low to adequately compensate you for your resulting injuries and treatment. We will determine how much you would likely be able to receive in a settlement or trial.

It starts with a phone call to us at 661-945-6969. The initial consultation is FREE.

How Can Kuzyk Personal Injury & Car Accidents Lawyers Recover a Proper and Comprehensive Amount for You?

If you are unsatisfied with the amount put forth by your insurance company, the next step is to file a personal injury lawsuit. This requires special skill, training, experience, and thorough knowledge of both the law and the insurance industry.

That’s why you need the assistance of a qualified personal injury lawyer to lead this charge. Going it alone puts you at the mercy of the insurance companies. They are out for blood, and you have enough stress to deal with as it is. Be smart and make the right choice to partner with us.

Remember, just because you call us to inquire about a personal injury lawsuit, doesn’t mean you automatically have a case. You may not. We will weigh all factors and discuss it with you. That phone call to us gives you peace of mind above anything else.

With more than 100,000 cases successfully settled, Kuzyk Personal Injury & Car Accidents Lawyers brings four decades of experience to personal injury law throughout Southern California. In cases with significant injuries and medical bills, we have been able to obtain six- and seven-figure settlements for many of our clients. Obtaining the maximum recovery is our top priority.

Our personal injury attorneys can assist you with medical referrals and services, at no up-front cost to you, so you can recover and return to work as quickly as possible. And remember, you don’t pay us unless we win you a settlement or court victory!

With personalized, face-to-face service, Kuzyk Personal Injury & Car Accidents Lawyers has your best interests at heart when it seems no one else does.