Injured by an uninsured motorist in Fresno, CA? Contact the top Fresno uninsured motorist accident lawyer to seek compensation.

Getting hit by an uninsured driver can leave you feeling helpless and financially vulnerable. You may wonder how you’ll cover medical bills, lost wages, or vehicle repairs.

A Fresno uninsured motorist accident lawyer can help you navigate these challenges and pursue compensation through your own insurance or other legal avenues. With the right attorney, you can level the playing field and protect your rights.

At Kuzyk Personal Injury & Car Accident Lawyers, we use our knowledge of California’s insurance laws and experience handling aggressive insurance companies to help clients navigate these complex claims and pursue compensation and justice.

Contact us to schedule a free consultation and discover how our award-winning car accident attorneys can help you seek the compensation and justice you deserve.

Do I Have a Claim If the Other Driver Has No Insurance?

Although California requires all drivers to carry liability insurance, the reality is that thousands of motorists in Fresno County drive without coverage every day. When these uninsured drivers cause accidents, victims often believe they have no path to compensation for their medical bills, lost wages, and vehicle repairs.

However, your own insurance policy likely contains protections specifically designed for these situations. California’s uninsured motorist laws require insurers to offer coverage that steps in when negligent drivers cannot pay for the harm they cause.

You can still pursue compensation even when the at-fault driver lacks insurance coverage. Your own auto insurance policy includes Uninsured Motorist coverage that protects you in these situations. This coverage acts as a safety net when negligent drivers cannot pay for the harm they cause.

Uninsured Motorist coverage applies in several common scenarios:

- No insurance at all: The at-fault driver has no active liability policy.

- Hit-and-run accidents: The responsible driver flees and cannot be identified.

- Expired or cancelled policies: The driver’s insurance lapsed before the accident.

- Fraudulent coverage: The driver provided fake insurance information.

Your UM coverage steps in to pay for medical bills, lost wages, and pain and suffering just like the at-fault driver’s insurance would have. The key difference is that you file the claim with your own insurance company instead of theirs.

What Does Uninsured Motorist Coverage Pay For?

Uninsured Motorist coverage compensates you for the same damages you could recover from a negligent driver’s insurance policy. This includes both economic losses like medical expenses and non-economic damages like pain and suffering. California requires all auto policies to include UM coverage, though you can reject it in writing.

The coverage typically pays for:

- Medical expenses: Hospital bills, surgery costs, physical therapy, and ongoing treatment.

- Lost income: Wages missed due to injury and reduced earning capacity

- Pain and suffering: Physical discomfort and emotional distress from the accident

- Property damage: Vehicle repairs if you have Uninsured Motorist Property Damage coverage

Understanding UM vs UIM Coverage

Uninsured Motorist and Underinsured Motorist coverage serve different purposes but work together to protect you. UM coverage applies when the at-fault driver has no insurance whatsoever. UIM coverage kicks in when the responsible party has insurance but not enough to cover your full damages.

For example, if your medical bills from a rear-end collision total $50,000 but the at-fault driver only has $15,000, UIM would pay the remaining $35,000 up to your policy limits. This distinction matters because the claims process differs slightly between the two types.

Medical Payments Vs Uninsured Motorist Coverage

In addition to UM and UIM coverage, Medical Payments coverage provides immediate payment for medical treatment regardless of fault. This optional coverage pays your medical bills quickly while you pursue your UM claim. However, MedPay has lower limits and only covers medical expenses, not lost wages or pain and suffering.

Your health insurance may also cover accident-related treatment but will likely seek reimbursement from any settlement you receive. We negotiate with health insurers to reduce these liens and maximize your net recovery.

When Does Your UM Coverage Apply?

Uninsured Motorist coverage protects more people than just the policyholder. The coverage extends to family members, passengers, and even pedestrians struck by uninsured drivers. Understanding who qualifies for coverage helps ensure you access all available compensation sources.

Family Members and Household Residents

Your UM policy also covers resident relatives living in your household, even if they are not named on the policy. This includes your spouse, children, and other family members who share your address. Coverage applies whether they are driving your vehicle, riding as passengers, or walking when struck by an uninsured motorist.

If a family member has their own auto policy, both policies may provide coverage. This creates an opportunity to “stack” coverage limits for greater compensation. Our attorneys analyze all applicable policies to maximize your recovery.

Passengers in Your Vehicle

Anyone riding in your car when struck by an uninsured driver is typically covered by your UM policy. This includes friends, coworkers, and other guests who have no relationship to you. Passengers may also have coverage under their own auto policies, creating additional compensation sources.

We investigate all potential coverage sources for passengers to ensure they receive full compensation. This thorough approach often reveals coverage that insurance companies fail to mention initially.

Hit-and-Run Requirements

California law imposes specific requirements for hit-and-run UM claims that do not apply to other uninsured motorist cases. You must prove physical contact occurred between the vehicles, not just that another driver caused you to crash. Additionally, you must report the accident to police within 24 hours and notify your insurer promptly.

These requirements protect against fraudulent claims but can create barriers for legitimate victims. We help clients gather the necessary evidence and meet all deadlines to preserve their right to compensation.

What UM Coverage Does Not Include

While Uninsured Motorist coverage provides valuable protection, it has important limitations you should understand. These exclusions can affect your claim strategy and the total compensation available. Knowing these limits helps set realistic expectations for your case outcome.

Property damage coverage under UM policies is limited in California. Most policies only provide minimal property damage coverage for uninsured motorist claims. You typically need collision coverage to fully protect your vehicle against uninsured drivers.

Additionally, punitive damages are generally not available through UM claims since these are designed to punish the at-fault party. However, if your own insurance company handles your claim in bad faith, you may have grounds for a separate lawsuit against them.

California Deadlines for UM Claims

Time limits for uninsured motorist claims are strictly enforced, and missing a deadline can permanently bar your recovery. California law sets different deadlines depending on the type of claim and the specific circumstances of your accident. Understanding these time limits is crucial for protecting your rights.

Statute of Limitations

In most cases, uou have two years from the date of the accident to file a lawsuit for personal injury damages. For property damage claims, the deadline extends to three years. However, your insurance policy may impose shorter deadlines for reporting claims or demanding arbitration.

Missing the statute of limitations deadline means you lose the right to pursue compensation forever. Courts rarely grant extensions, even for compelling reasons. This is why contacting an attorney immediately after an accident is so important.

Insurance Policy Deadlines

Your auto insurance policy contains specific deadlines for reporting claims and cooperating with the investigation. Most policies require prompt notice of accidents and may void coverage for unreasonable delays. The definition of “prompt” varies by insurer and circumstances.

For hit-and-run claims, you must report to police within 24 hours and notify your insurer as soon as reasonably possible. These deadlines are strictly enforced because they help insurers investigate claims while evidence is fresh.

Arbitration Demands

If you cannot reach a settlement with your insurance company, you may need to demand arbitration or file a lawsuit. California law requires this demand within two years of the accident. Arbitration is often faster and less expensive than court litigation but still requires careful preparation.

We handle all deadline compliance for our clients to ensure no rights are lost due to missed time limits. This includes calendaring all important dates and taking action well before deadlines approach.

Steps to Take After an Uninsured Motorist Accident

Your actions immediately after an accident with an uninsured driver, including drunk driving accidents where drivers often lack adequate coverage, can significantly impact your ability to recover compensation. Following the right steps protects your health, preserves evidence, and strengthens your legal claim. Here is what you should do:

- Call 911 immediately: Report the accident and request medical assistance if needed. A police report is essential for hit-and-run UM claims and helpful for all uninsured motorist cases.

- Seek medical attention: Get examined by a healthcare provider even if you feel fine initially. Some injuries do not show symptoms right away but can become serious if untreated.

- Document everything: Take photos of vehicle damage, injuries, and the accident scene. Get contact information from witnesses who saw what happened.

- Notify your insurer: Report the accident to your insurance company, but avoid giving detailed statements until you consult with an attorney.

Common Mistakes That Damage UM Claims

Many accident victims unknowingly harm their claims by making these common errors:

- Delaying medical treatment: Insurance companies use treatment gaps to argue injuries are not serious.

- Admitting fault: Any statement suggesting you caused or contributed to the accident reduces your compensation.

- Accepting quick settlements: Early offers rarely reflect the full value of your claim.

- Missing deadlines: Late reporting or missed arbitration demands can void your coverage.

We guide clients through the claims process to avoid these pitfalls while building the strongest possible case for maximum compensation.

How Our Fresno Uninsured Motorist Lawyers Help

Dealing with your own insurance company after an uninsured motorist accident can be surprisingly difficult. Insurers have a financial incentive to minimize payouts even on UM claims. Our experienced attorneys level the playing field by advocating aggressively for your rights.

Thorough Investigation and Evidence Collection

We immediately begin investigating your accident to gather evidence supporting your claim. This includes obtaining police reports, interviewing witnesses, and analyzing vehicle damage patterns. For hit-and-run cases, we work with investigators to identify the responsible driver when possible.

Our team also reviews your insurance policy to identify all available coverage sources. Many clients have multiple policies that provide overlapping coverage, increasing the total compensation available.

Medical Documentation and Treatment Coordination

Proper medical documentation is crucial for maximizing your UM claim value. We work with your healthcare providers to ensure all injuries are properly diagnosed and documented. This includes connecting you with specialists when necessary and ensuring consistent care.

We also coordinate with medical providers regarding billing and liens to protect your interests. This prevents surprise bills later and ensures more of your settlement goes to you rather than healthcare providers.

Negotiation and Dispute Resolution

Insurance companies often make lowball settlement offers, hoping you will accept less than your claim is worth. Our attorneys have decades of experience negotiating with insurers and know how to counter their tactics effectively.

If negotiations fail to produce a fair settlement, we are prepared to take your case to arbitration or court. Most UM disputes are resolved through binding arbitration, which we handle from start to finish on your behalf.

Compensation Available in UM Claims

The amount of compensation you can recover depends on your policy limits and the severity of your injuries. California allows you to purchase UM coverage up to your liability limits, with higher limits providing greater protection. We help you understand what your policy covers and fight for every dollar available.

Economic Damages

Economic damages compensate for your financial losses from the accident. These damages are typically easier to calculate because they have specific dollar amounts attached. However, future losses require careful analysis and expert testimony to establish their value.

Your economic damages may include:

- Past and future medical expenses: All treatment costs related to your injuries.

- Lost wages and benefits: Income missed due to time off work.

- Reduced earning capacity: Permanent impact on your ability to earn income.

- Property damage: Vehicle repairs or replacement value.

Non-Economic Damages

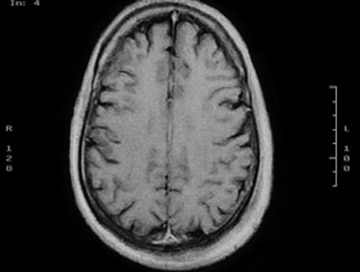

Non-economic damages compensate for the physical and emotional impact of your injuries, especially in cases involving catastrophic injuries such as traumatic brain injuries or paralysis. These damages are more subjective but often represent the largest portion of your claim value. California does not cap non-economic damages in most personal injury cases.

Pain and suffering includes both physical discomfort and emotional distress from the accident. This encompasses anxiety, depression, loss of enjoyment of life, and other intangible harms. We work with medical experts and life care planners to document these impacts thoroughly.

Wrongful Death Benefits

If you lost a loved one in an accident caused by an uninsured driver, you may be entitled to wrongful death benefits through UM coverage. These benefits help surviving family members cope with the financial impact of their loss while providing some measure of justice.

Wrongful death benefits typically include funeral expenses, lost financial support, and compensation for the loss of companionship and guidance. Each case is unique, and the available compensation depends on the deceased person’s age, income, and family relationships.

What If You Have No UM Coverage?

Not having Uninsured Motorist coverage significantly limits your options but does not eliminate them entirely. We explore every possible avenue for compensation when UM coverage is unavailable. This requires creative legal strategies and thorough investigation of all potentially responsible parties.

Third-Party Liability Claims

Sometimes other parties besides the uninsured driver bear responsibility for your accident. This could include the vehicle owner if they negligently entrusted their car to an uninsured driver. Employers may be liable if their employee caused the accident while working.

We also investigate whether defective vehicle parts, dangerous road conditions, or other factors contributed to your accident. These additional defendants may have insurance coverage or assets available to compensate you.

Asset Investigation and Collection

Even uninsured drivers may have assets that can be seized to satisfy a judgment. This includes real estate, bank accounts, and valuable personal property. However, collection can be difficult and time-consuming, making this option less reliable than insurance coverage.

We work with investigators and collection specialists to identify and pursue any available assets. While this approach requires patience, it can sometimes lead to meaningful recovery for our clients.

Why Choose Kuzyk Law for Your UM Claim

Kuzyk Personal Injury & Car Accident Lawyers handles uninsured motorist claims in Fresno and throughout California. We have helped many clients recover compensation for their injuries, including those with complex uninsured motorist claims. Our track record speaks to our commitment to achieving the best possible outcomes for our clients.

Local Knowledge and Experience

Our deep roots in the Fresno community give us unique insights into local courts, insurance practices, and medical providers. We know which insurers try to underpay claims and how to counter their tactics effectively. This local knowledge translates into better results for our clients.

We also maintain relationships with medical specialists, accident reconstruction experts, and other professionals who strengthen our clients’ cases. These resources are particularly valuable in complex UM claims that require extensive expert testimony.

Comprehensive Client Support

We understand that dealing with injuries and insurance claims creates stress beyond the physical pain of your accident. Our team provides comprehensive support throughout the legal process, handling all communications with insurers while keeping you informed of important developments.

Our support includes helping you find appropriate medical care, coordinating with treatment providers, and ensuring you understand each step of the claims process. We are available 24/7 to answer questions and provide guidance when you need it most.

Uninsured Motorist Accident FAQs

Can I Sue an Uninsured Driver Directly in California?

You can file a lawsuit against an uninsured driver, but collecting compensation is often difficult since they lack insurance coverage and may have limited assets. In most cases, your Uninsured Motorist (UM) coverage typically provides more reliable compensation than pursuing the uninsured driver personally.

Will Filing a UM Claim Raise My Insurance Rates?

California law prohibits insurance companies from raising your rates for filing a not-at-fault UM claim. However, some insurers may try to increase rates at renewal time, which is why proper claim handling is important.

How Long Does It Take to Resolve a UM Claim in Fresno?

UM claim resolution time varies depending on injury severity, policy limits, and insurer cooperation. Simple cases may settle within months, while complex claims involving serious injuries can take a year or more to resolve fully.

Contact Fresno Uninsured Motorist Accident Lawyer

Do not let an uninsured driver leave you struggling with medical bills and lost income. The experienced attorneys at Kuzyk Personal Injury & Car Accident Lawyers are ready to fight for the compensation you deserve. We offer free consultations to discuss your case and explain your legal options with no obligation.

Our contingency fee arrangement means you pay no attorney fees unless we recover compensation for you. This ensures you can access experienced legal representation regardless of your financial situation. Contact us today to begin your journey toward fair compensation and financial recovery.

Call (661) 945-6969 or visit our website to schedule your free consultation. Let our four decades of experience work for you during this challenging time.